With a market cap of $83.7 billion, U.S. Bancorp (USB) is a diversified financial services holding company that provides banking, lending, payment, investment, and trust services to individuals, businesses, institutions, and government entities across the United States. The company operates through multiple segments, including consumer and business banking, wealth management, payment services, and corporate and institutional banking.

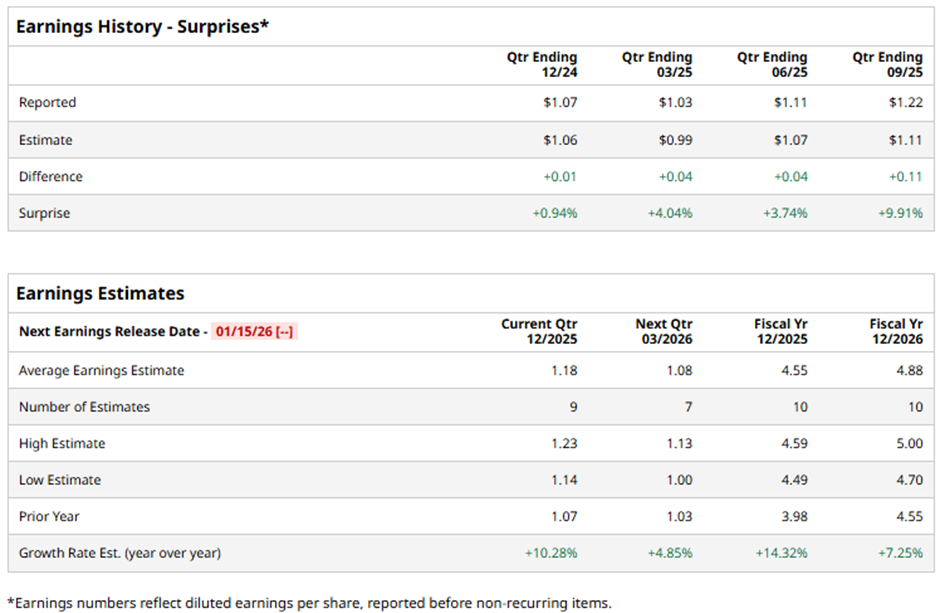

The Minneapolis, Minnesota-based company is set to announce its fiscal Q4 2025 results soon. Ahead of this event, analysts forecast USB to report a profit of $1.18 per share, an increase of 10.3% from $1.07 per share in the year-ago quarter. It has surpassed Wall Street's earnings estimates in the last four quarters.

For fiscal 2025, analysts expect the regional banking leader to report an EPS of $4.55, up 14.3% from $3.98 in fiscal 2024.

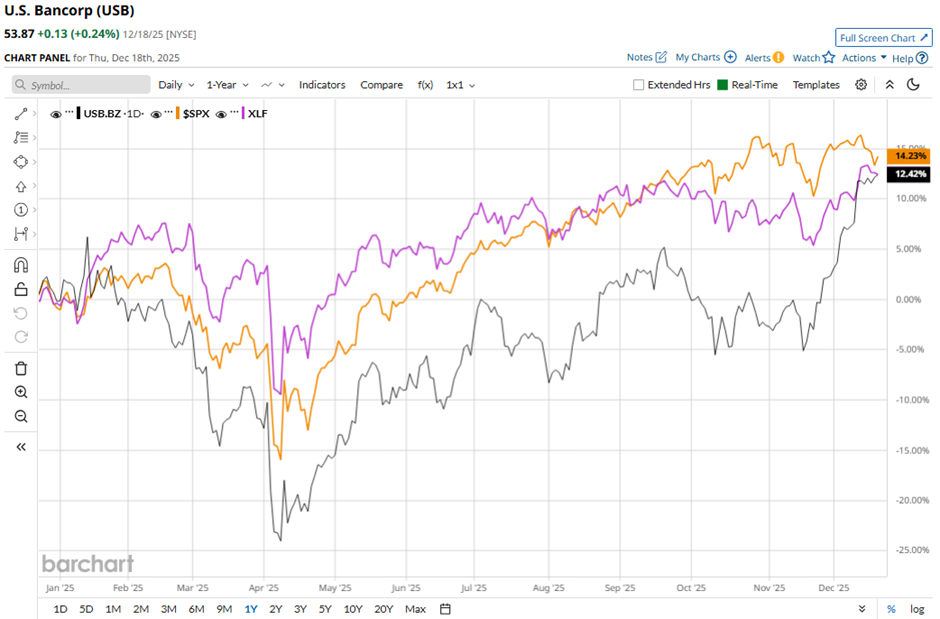

Shares of U.S. Bancorp have soared 13.2% over the past 52 weeks, lagging behind both the S&P 500 Index's ($SPX) 15.4% increase and the Financial Select Sector SPDR Fund's (XLF) 14.5% return over the same period.

U.S. Bancorp reported a strong Q3 2025 profit jump of 18% on Oct. 16, with net income rising to $1.89 billion, or $1.22 per share. USB also posted robust fee income growth of 9.5%, including a 9.3% surge in capital markets fees and a 9.4% increase in trust and investment management fees. Additionally, net interest income rose 2.1% to $4.22 billion, beating management expectations. However, the stock fell 1.7% on that day.

Analysts' consensus view on USB stock is cautiously optimistic, with a "Moderate Buy" rating overall. Among 24 analysts covering the stock, 12 recommend "Strong Buy," one has a "Moderate Buy," 10 "Holds," and one suggests "Strong Sell." The average analyst price target for U.S. Bancorp is $56.15, suggesting a potential upside of 4.2% from current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- 1 Analyst Is Betting on 73% Upside Potential for D-Wave Quantum Stock. Should You Buy QBTS Shares Here?

- This 1 Lesser-Known Stock Is Set to Dominate with Nvidia and Broadcom in 2026

- This Flying Car Stock Just Announced a Major Production Update. Should You Buy Shares for 2026?

- How to Turn the Volatility in Tesla Stock into a 20% Upside Opportunity with Just 0.3% Downside Risk