Texas Instruments (TXN)

215.55

-3.42 (-1.56%)

NASDAQ · Last Trade: Feb 1st, 6:46 AM EST

The Vanguard Total Corporate Bond ETF tracks investment-grade U.S. corporate bonds with a low-cost, index-based approach.

Via The Motley Fool · January 31, 2026

This ETF tracks the latest 3-month U.S. Treasury Bill, offering investors daily liquidity and a competitive yield in the fixed income space.

Via The Motley Fool · January 31, 2026

It's presently selling into one of the most lively segments of the tech sphere.

Via The Motley Fool · January 30, 2026

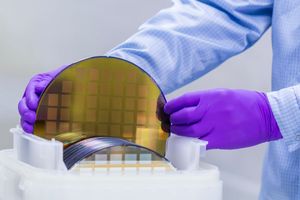

As of January 30, 2026, the United States' ambitious effort to repatriate semiconductor manufacturing has officially transitioned from a period of legislative hype and groundbreaking ceremonies to a reality of high-volume manufacturing (HVM). With over $30 billion in federal awards from the CHIPS and Science Act now flowing into the ecosystem, the "Silicon Desert" of [...]

Via TokenRing AI · January 30, 2026

In a landmark moment for the American semiconductor industry, Texas Instruments (NASDAQ: TXN) has officially commenced volume production at its state-of-the-art SM1 fab in Sherman, Texas. The facility, which began shipping its first 300mm wafers to customers in late December 2025, represents the first phase of a massive $60 billion investment strategy aimed at securing [...]

Via TokenRing AI · January 30, 2026

Check out the companies making headlines this week:

Via StockStory · January 30, 2026

TEXAS INSTRUMENTS INC (NASDAQ:TXN): A Quality Dividend Stock for Long-Term Investorschartmill.com

Via Chartmill · January 30, 2026

Anthropic's revenue is expected to grow faster than initially anticipated.

Via The Motley Fool · January 29, 2026

TXN Shares Soar 8% After Hours: What’s Driving Investor Optimism Despite Q4 Earnings Miss?stocktwits.com

Via Stocktwits · January 27, 2026

Texas Instruments Inc. (NASDAQ:TXN) Q4 2025 Earnings: Revenue and EPS Miss, but Strong Outlook Fuels Stock Surgechartmill.com

Via Chartmill · January 27, 2026

Via MarketBeat · January 29, 2026

Texas Instruments posted a technical earnings miss. Investors shrugged and bought the stock anyway.

Via The Motley Fool · January 28, 2026

As the 2026 tax filing season begins, the American economy is navigating a radical transformation defined by Treasury Secretary Scott Bessent’s "non-inflationary boom" strategy. This ambitious economic experiment, centered on the "One Big Beautiful Bill" (OBBB)—officially the Working Families Tax Cut Act—represents the most significant shift in

Via MarketMinute · January 28, 2026

Top gainers and losers in the S&P500 index during Tuesday's after-hours session.chartmill.com

Via Chartmill · January 27, 2026

What's going on in today's session: S&P500 moverschartmill.com

Via Chartmill · January 28, 2026

Shares of analog chip manufacturer Texas Instruments (NASDAQ:TXN)

jumped 9% in the afternoon session after the company's optimistic forecast for the upcoming quarter overshadowed its mixed fourth-quarter financial results.

Via StockStory · January 28, 2026

These S&P500 stocks are moving in today's sessionchartmill.com

Via Chartmill · January 28, 2026

As the global semiconductor industry enters a new era of domestic resilience and advanced manufacturing, few companies stand at a more significant crossroads than Texas Instruments Incorporated (NASDAQ: TXN). Long considered the "blue chip" of the analog world, TI has spent the last five years executing one of the most aggressive capital expenditure programs in [...]

Via Finterra · January 28, 2026

Which S&P500 stocks are gapping on Wednesday?chartmill.com

Via Chartmill · January 28, 2026

Wondering what's happening in today's S&P500 pre-market session?chartmill.com

Via Chartmill · January 28, 2026

Tech Floats the Index While Health Care Springs a Leakchartmill.com

Via Chartmill · January 28, 2026

Analog chip manufacturer Texas Instruments (NASDAQ:TXN) fell short of the markets revenue expectations in Q4 CY2025, but sales rose 10.4% year on year to $4.42 billion. On the other hand, next quarter’s outlook exceeded expectations with revenue guided to $4.5 billion at the midpoint, or 1.7% above analysts’ estimates. Its GAAP profit of $1.27 per share was 2.9% below analysts’ consensus estimates.

Via StockStory · January 28, 2026

Texas Instruments (TXN) Earnings Transcript

Via The Motley Fool · January 27, 2026

Analog chip manufacturer Texas Instruments (NASDAQ:TXN) fell short of the markets revenue expectations in Q4 CY2025, but sales rose 10.4% year on year to $4.42 billion. On the other hand, next quarter’s outlook exceeded expectations with revenue guided to $4.5 billion at the midpoint, or 1.7% above analysts’ estimates. Its GAAP profit of $1.27 per share was 2.9% below analysts’ consensus estimates.

Via StockStory · January 27, 2026

Tuesday's after hours session: top gainers and loserschartmill.com

Via Chartmill · January 27, 2026