Warner Bros. Discovery, Inc. - Series A Common Stock (WBD)

27.36

+0.60 (2.24%)

NASDAQ · Last Trade: Feb 6th, 8:05 PM EST

The digital landscape witnessed a seismic shift on February 6, 2026, as shares of Roblox (NYSE: RBLX) soared more than 10% in early trading following a blockbuster fourth-quarter earnings report. The company, once viewed primarily as a playground for children, proved to Wall Street that its transition into a multi-generational

Via MarketMinute · February 6, 2026

The Wall Street Journal reported that the Justice Department is probing whether Netflix was involved in anticompetitive tactics as part of its investigation into its proposed buyout of Warner Bros Discovery’s studios and streaming service.

Via Stocktwits · February 6, 2026

In a move that has sent shockwaves through both Silicon Valley and the San Fernando Valley, The Walt Disney Company (NYSE: DIS) has officially cemented its status as the pioneer of the AI-driven entertainment era. Following a landmark $1 billion equity investment and a three-year licensing agreement with OpenAI, Disney is integrating its most iconic [...]

Via TokenRing AI · February 6, 2026

In a definitive signal that the investment banking winter has not only thawed but shifted into a high-intensity burn, Evercore (NYSE: EVR) reported a staggering Q4 2025 earnings beat this week, posting an adjusted earnings per share (EPS) of $5.13. The result, which blew past analyst estimates of $4.

Via MarketMinute · February 6, 2026

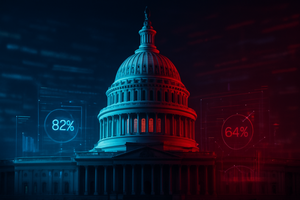

As the 2026 midterm election cycle enters its most volatile phase, prediction markets have coalesced around a startlingly clear vision of the future: a deeply divided Washington. According to the latest data from Polymarket and Kalshi, the probability of Democrats retaking the House of Representatives has surged to a dominant 82%, while Republicans maintain a [...]

Via PredictStreet · February 6, 2026

As of February 6, 2026, the media and entertainment landscape is undergoing a tectonic shift not seen in nearly a decade. The industry has been rocked by the formal announcement and subsequent regulatory scrutiny of Netflix (NASDAQ:NFLX)'s staggering $82.7 billion acquisition of the core film and television

Via MarketMinute · February 6, 2026

As of February 6, 2026, the global financial landscape is still reverberating from a historic tectonic shift that occurred in the final months of last year. In the fourth quarter of 2025, the M&A market witnessed an unprecedented "mega-deal" frenzy, with 22 global transactions valued at over $10 billion

Via MarketMinute · February 6, 2026

The streaming leader's 2026 could look a lot different from 2025.

Via The Motley Fool · February 6, 2026

The "Great Hesitation" in global finance has officially come to an end. In the opening weeks of 2026, the private equity landscape has undergone a dramatic transformation, shifting from two years of defensive posturing to a full-scale dealmaking renaissance. Driven by a record-shattering $2 trillion in "dry powder" and a

Via MarketMinute · February 5, 2026

In the world of finance, information has always been the most valuable currency. But as of early 2026, how that information is gathered, verified, and broadcast has undergone a fundamental transformation. The 2024 U.S. Election was the "proof-of-concept" for prediction markets; today, they have become the "Oracle Layer" for the global economy. Major media conglomerates, [...]

Via PredictStreet · February 5, 2026

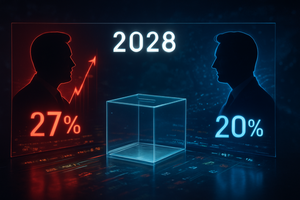

While the dust of the 2024 election cycle has barely settled, the financial world is already placing its bets on the next battle for the White House. As of February 2026, prediction markets—the once-niche platforms that successfully forecasted the 2024 outcome with surgical precision—are signaling a clear trajectory for the 2028 U.S. Presidential Election. Vice [...]

Via PredictStreet · February 5, 2026

Netflix management recently argued in front of a Senate committee that its proposed deal would strengthen Hollywood.

Via Stocktwits · February 5, 2026

Netflix and WBD are facing a skeptical Senate panel Tuesday to defend their $82.7 billion media merger against concerns it will hurt competition in the streaming market.

Via Stocktwits · February 3, 2026

Regulators are already concerned that a Netflix-Warner Bros. deal could raise significant antitrust issues.

Via The Motley Fool · February 3, 2026

Netflix shares keep falling despite solid earnings. Here's what's driving the drama.

Via The Motley Fool · February 3, 2026

The landscape of artificial intelligence underwent a tectonic shift following Tesla’s (NASDAQ: TSLA) landmark "We, Robot" event, a spectacle that transitioned the company from a mere automaker into a vanguard of embodied AI. While the event initially faced scrutiny over its theatrical nature, the intervening months leading into early 2026 have proven it to be [...]

Via TokenRing AI · February 2, 2026

The media landscape reached a fever pitch this week as Netflix (NASDAQ:NFLX) and Warner Bros. Discovery (NASDAQ:WBD) finalized terms for a massive $82.7 billion merger, a deal poised to redefine the "streaming wars" by consolidating Hollywood’s most storied assets under a single digital roof. As of

Via MarketMinute · February 2, 2026

As of early February 2026, the financial world has officially crossed the Rubicon. Prediction markets, once relegated to the fringes of internet forums and academic theory, have fully integrated into the DNA of the global financial system. The tipping point arrived not with a single event, but through a series of massive institutional migrations that [...]

Via PredictStreet · February 2, 2026

The Walt Disney Company (DIS) reported its fiscal first-quarter results for 2026 on February 2, 2026, revealing a complex financial landscape where record-breaking top-line revenue was tempered by a dip in overall net profit. While the media giant successfully steered its direct-to-consumer (DTC) segment into a reliable profit engine, the

Via MarketMinute · February 2, 2026

The traditional news ticker is undergoing a radical transformation. As of February 1, 2026, the familiar crawl of stock prices and weather updates has been joined—and in some cases replaced—by a far more dynamic metric: real-time "wisdom of the crowd" probabilities. From the halls of the U.S. Congress to the red carpets of Hollywood, prediction [...]

Via PredictStreet · February 1, 2026

In all three cases it started with a must-have product or service that's easy and affordable enough to buy over and over again.

Via The Motley Fool · February 1, 2026

The market's focusing on the wrong details of this bold but admittedly expensive acquisition effort.

Via The Motley Fool · January 31, 2026

Tesla's robotaxis are finally driving without a safety driver in the front seat, so we're discussing future business models for Tesla, and also Greg Abel making a mark on Berkshire Hathaway, Apple's chatbot, and 24/7 trading.

Via The Motley Fool · January 30, 2026

Netflix reported earnings and results were solid, but guidance left investors wanting more.

Via The Motley Fool · January 29, 2026

Netflix may be forced to offer all cash for WBD if the cable assets being spun off don't have the value Netflix thought they did. But is that something Netflix will do, and what are the risks?

Via The Motley Fool · January 29, 2026