Eli Lilly (LLY)

1,058.18

+37.34 (3.66%)

NYSE · Last Trade: Feb 7th, 6:11 AM EST

Detailed Quote

| Previous Close | 1,020.84 |

|---|---|

| Open | 1,056.00 |

| Bid | 1,068.55 |

| Ask | 1,069.10 |

| Day's Range | 1,033.27 - 1,060.02 |

| 52 Week Range | 623.78 - 1,133.95 |

| Volume | 4,887,170 |

| Market Cap | 1.01T |

| PE Ratio (TTM) | 51.77 |

| EPS (TTM) | 20.4 |

| Dividend & Yield | 6.000 (0.57%) |

| 1 Month Average Volume | 3,535,297 |

Chart

About Eli Lilly (LLY)

Eli Lilly is a global pharmaceutical company dedicated to discovering, developing, manufacturing, and marketing innovative medicines that address some of the world's most challenging health issues. The company focuses on areas such as diabetes, oncology, immunology, and neurodegenerative diseases, providing a wide range of treatments designed to improve patient outcomes and quality of life. Eli Lilly is committed to scientific advancement and works collaboratively with healthcare professionals and researchers to bring new therapies and solutions to market, ensuring access to life-saving medications for patients around the globe. Read More

News & Press Releases

Tom Lee says the S&P 500 (a benchmark for the U.S. stock market) can hit 15,000 by 2030.

Via The Motley Fool · February 7, 2026

Via MarketBeat · February 6, 2026

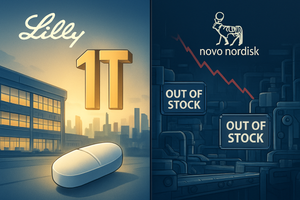

Eli Lilly and Company (NYSE: LLY) has officially entered the "trillion-dollar club" with a roar, issuing a blockbuster financial guidance for 2026 that projects revenue between $80 billion and $83 billion. The announcement, made during the company’s early February earnings call, marks a historic turning point in the pharmaceutical

Via MarketMinute · February 6, 2026

Biogen Inc. (NASDAQ: BIIB) reported its fourth-quarter and full-year 2025 financial results on February 6, 2026, signaling a definitive shift from a legacy company plagued by patent cliffs to a leaner, growth-oriented neurology powerhouse. Despite a 7% year-over-year revenue decline to $2.28 billion, the company beat Wall Street expectations

Via MarketMinute · February 6, 2026

The market for obesity drugs may soon reach almost $100 billion.

Via The Motley Fool · February 6, 2026

In a breakthrough that many are calling the "Penicillin Moment" of the 21st century, researchers at the Massachusetts Institute of Technology, led by bioengineering pioneer James Collins, have successfully leveraged generative AI to discover an entirely new class of antibiotics capable of neutralizing the deadly, drug-resistant superbug MRSA. This development, which reached a critical clinical [...]

Via TokenRing AI · February 6, 2026

The long-standing duopoly of the weight-loss drug market faced its most significant challenge yet this week as Hims & Hers Health, Inc. (NYSE: HIMS) announced a breakthrough $49 compounded oral semaglutide pill. The move, aimed directly at the market share of pharmaceutical titans Eli Lilly and Company (NYSE: LLY) and Novo

Via MarketMinute · February 6, 2026

The drugmaker is facing pricing pressures on its weight loss medications.

Via The Motley Fool · February 6, 2026

The global race for obesity market dominance reached a historic turning point this week as Eli Lilly and Company (NYSE: LLY) officially crossed the $1 trillion market capitalization threshold, cementing its status as the world’s most valuable healthcare entity. The milestone follows a stellar 2026 guidance report that projected

Via MarketMinute · February 6, 2026

The life sciences sector has entered 2026 in the midst of a historic transformation, as deal volume and value surged by a staggering 82% over the past year. This "Great Rebound," fueled by a record-shattering $240 billion in total M&A investment in 2025, represents a fundamental shift in how

Via MarketMinute · February 6, 2026

As of February 6, 2026, AstraZeneca PLC (NASDAQ: AZN) stands as a case study in corporate resilience and strategic reinvention. Once a company teetering on the edge of a massive patent cliff a decade ago, the British-Swedish multinational has transformed into a high-growth oncology and rare disease powerhouse. With a market capitalization now rivaling the [...]

Via Finterra · February 6, 2026

As of February 6, 2026, Biogen Inc. (NASDAQ: BIIB) stands at a critical crossroads in its nearly 50-year history. Once the undisputed titan of the Multiple Sclerosis (MS) market, the Cambridge-based biotechnology pioneer is now navigating an aggressive and complex transition. Under the leadership of CEO Christopher Viehbacher, Biogen has spent the last two years [...]

Via Finterra · February 6, 2026

Date: February 6, 2026 Introduction Alphabet Inc. (NASDAQ: GOOGL / GOOG) currently stands at the most consequential crossroads in its 28-year history. Once the undisputed king of the information age, the company is now navigating a transition into the "Agentic AI" era—a shift that has forced a radical transformation of its balance sheet. On February [...]

Via Finterra · February 6, 2026

These S&P500 stocks that are showing activity before the opening bell on Friday.chartmill.com

Via Chartmill · February 6, 2026

Two standout companies from the same sector (no, not technology) have a clear path to follow in Walmart's footsteps.

Via The Motley Fool · February 6, 2026

The stock’s rise followed FDA Commissioner Marty Makary's warning against companies marketing illegal copycat drugs.

Via Stocktwits · February 5, 2026

There's another fight brewing around GLP-1 drugs -- this time on the delivery side.

Via The Motley Fool · February 5, 2026

As of early February 2026, the long-standing dominance of high-growth technology and artificial intelligence (AI) stocks has hit a significant wall, triggering a massive "Great Rebalancing" across the U.S. financial markets. Investors, once captivated by the promise of infinite AI scaling, are now rotating aggressively into defensive and value-oriented

Via MarketMinute · February 5, 2026

Via MarketBeat · February 5, 2026

The global economic landscape has been jolted in the opening weeks of 2026 as the United States government formalizes a series of aggressive 25% tariff proposals targeting the critical sectors of semiconductors, automobiles, and pharmaceuticals. These measures, framed as essential for national security and domestic industrial revitalization, have sent shockwaves

Via MarketMinute · February 5, 2026

In a dramatic week for the pharmaceutical sector, a stark rift has opened between the two undisputed titans of the weight-loss drug market. On February 4, 2026, Eli Lilly (NYSE:LLY) reported a staggering 45% surge in full-year 2025 revenue, propelled by the insatiable global demand for its blockbuster treatments,

Via MarketMinute · February 5, 2026

Scott+Scott Attorneys at Law LLP (“Scott+Scott”), an international securities and consumer rights litigation firm, is investigating whether the leadership of Eli Lilly and Company (“Eli Lilly”) (NYSE: LLY) breached their fiduciary duties to Eli Lilly and its shareholders.

By Scott+Scott Attorneys at Law LLP · Via Business Wire · February 5, 2026

The stock price has climbed in the triple digits over three years.

Via The Motley Fool · February 5, 2026

Cantor says Eli Lilly's 2026 outlook eases GLP-1 pricing worries, raises its price target, and expects strong sales growth driven by incretin drugs and orforglipron prescriptions.

Via Benzinga · February 5, 2026